Markets

The Trump Effect on Currencies

The Trump Effect on Currencies

Rhetoric has already had an impact on currencies in a big way

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Targeting companies or entire nations on Twitter is an unprecedented and controversial method of communication for a President-elect – but one can’t argue with its effectiveness so far.

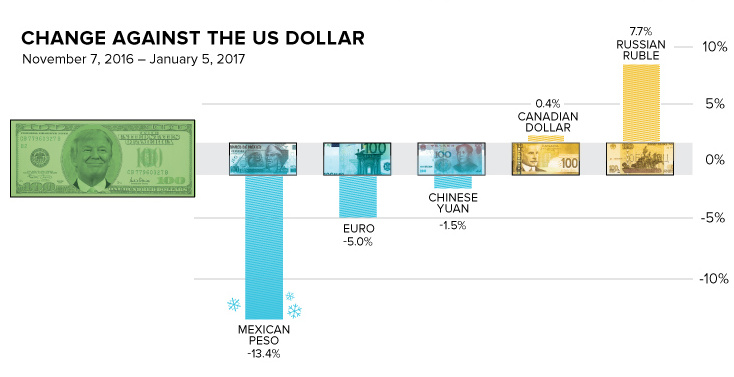

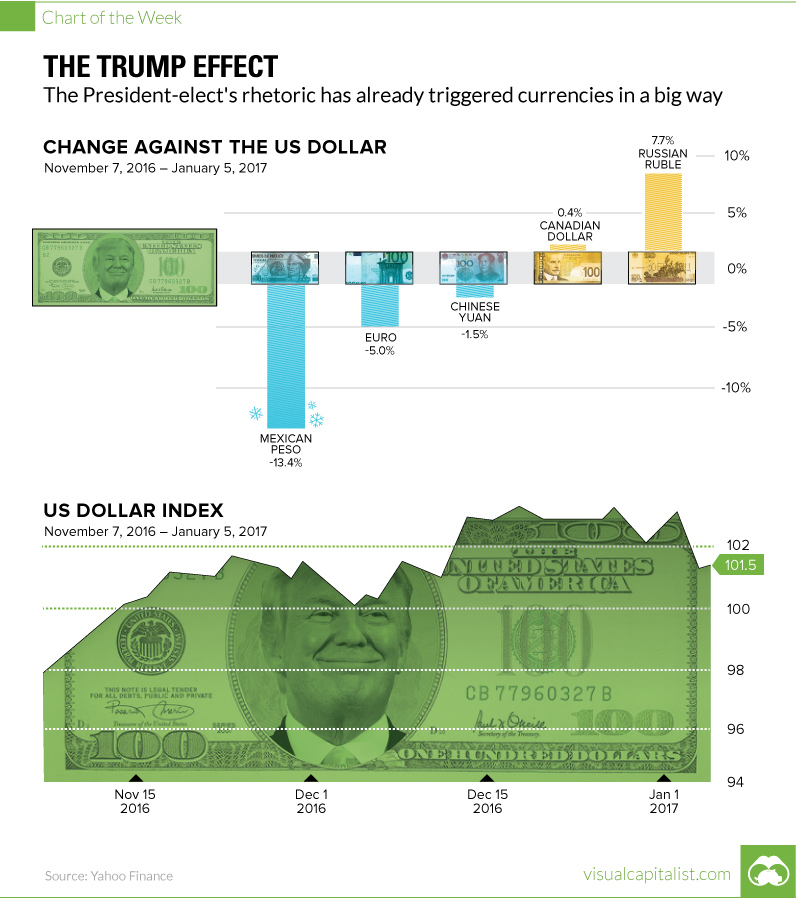

In today’s chart, we take a look at Donald Trump’s rather unconventional form of “monetary policy”, and how it has potentially influenced the U.S. dollar and five other major currencies since his election in November.

Ready, Aim, Tweet

A preview of President-elect Trump’s “America First” directive can already be seen on Twitter.

Trump’s infamous account, which is followed by 18.8 million people, is being used every day to highlight the potential winners and losers of future policies.

And markets are listening.

| Currency | % Change (vs. USD) |

|---|---|

| Russian Ruble | 7.7% |

| Canadian Dollar | 0.4% |

| Chinese Yuan | -1.5% |

| Euro | -5.0% |

| Mexican Peso | -13.4% |

The above table shows change in the value of foreign currencies against the U.S. dollar between November 7th, 2016 and today. To be fair, it is worth noting that oil prices have also rallied over this time, and oil also has a pronounced effect on some currencies.

Individual Cases

Central to “America First” is a Trump-branded form of protectionism, which aims to keep jobs and dollars in the U.S at all costs. The President-elect has repeatedly blasted China for currency manipulation, as well as automotive companies which seek to produce cars in Mexico.

General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border. Make in U.S.A.or pay big border tax!

— Donald J. Trump (@realDonaldTrump) January 3, 2017

China, as one of the world’s major economic powers, has some leeway in any war of words with Trump. While the country sends 18% of its exports to the United States, it could also theoretically benefit economically with the U.S. taking a step back from foreign entanglements. China also holds $1.12 trillion of U.S. treasuries, which gives it some additional leverage.

On the other hand, Mexico has a lot more to worry about. The country sends 80.3% of its exports north of the border and could conceivably lose significant amounts of business if NAFTA is scrapped and tariffs are re-introduced. As a result, even with oil’s gains over the last two months, the peso has dropped -13.4% in value since Trump’s election in November.

An Unlikely Friend

On the opposite side of the spectrum, Trump has been making moves to warm up relations with Russia – a protectionist country that isn’t really a “threat” to U.S. jobs.

Great move on delay (by V. Putin) – I always knew he was very smart!

— Donald J. Trump (@realDonaldTrump) December 30, 2016

Russia, which has been on Trump’s “good side” so far, has had its ruble trade 7.7% higher since the election. These gains partially reflect the future easing of sanctions that were put in place after Moscow’s aggression toward Ukraine in 2014.

Economy

The Most Valuable Companies in Major EU Economies

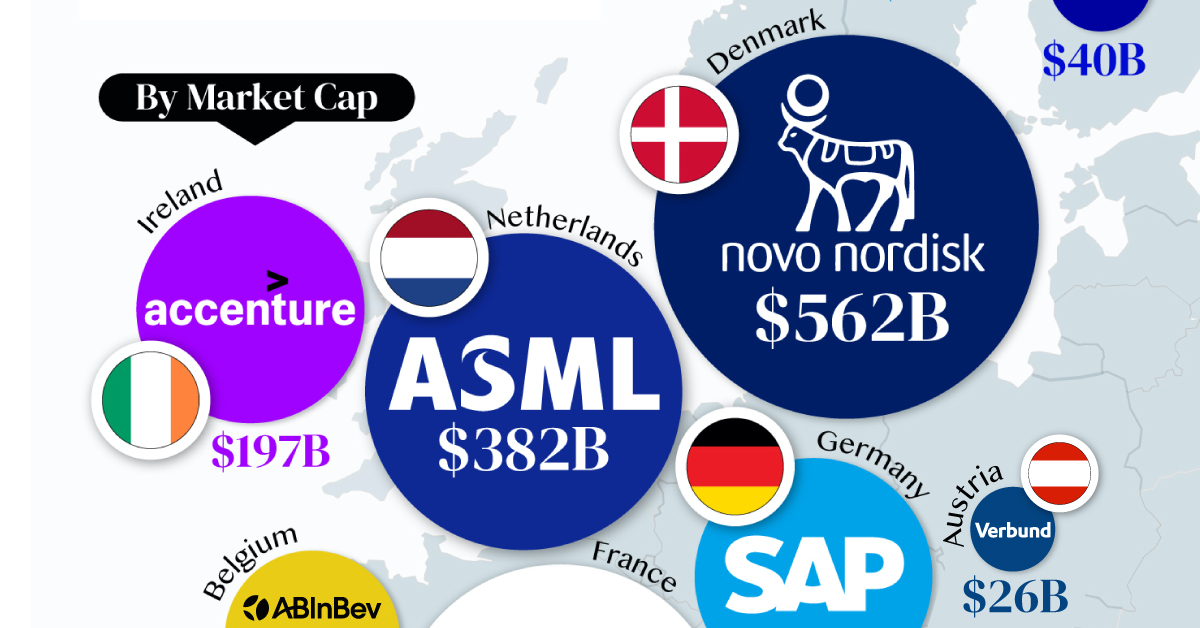

From semiconductor equipment manufacturers to supercar makers, the EU’s most valuable companies run the gamut of industries.

Most Valuable Companies in the EU, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we mapped out the most valuable corporations in 11 major EU economies, based on their market capitalizations as of April 15th, 2024. All figures are in USD, and were sourced from Companiesmarketcap.com.

Novo Nordisk is currently worth more than $550 billion, making it Europe’s most valuable company by a wide margin. The pharmaceutical giant specializes in diabetes and weight-loss drugs. Demand for two of them, Ozempic and Wegovy, has surged due to their weight-loss capabilities, even causing nationwide shortages in the United States.

The following table includes an expanded list of the most valuable publicly-traded company in larger EU economies. Many of these were not included in the graphic due to space limitations.

| Country | Company | Sector | Market Cap |

|---|---|---|---|

| 🇩🇰 Denmark | 💊 Novo Nordisk | Pharmaceuticals | $562B |

| 🇫🇷 France | 👜 LVMH | Luxury Goods | $422B |

| 🇳🇱 Netherlands | 🔧 ASML | Semiconductor Equipment | $382B |

| 🇩🇪 Germany | 💼 SAP | Enterprise Software | $214B |

| 🇮🇪 Ireland | 🖥️ Accenture | IT Services | $197B |

| 🇪🇸 Spain | 👗 Inditex | Retail | $147B |

| 🇧🇪 Belgium | 🍻 Anheuser-Busch InBev | Beverages | $116B |

| 🇸🇪 Sweden | 🛠️ Atlas Copco | Industrial Equipment | $80B |

| 🇮🇹 Italy | 🏎️ Ferrari | Automotive | $76B |

| 🇫🇮 Finland | 🏦 Nordea Bank | Banking | $40B |

| 🇦🇹 Austria | 🔌 Verbund AG | Energy | $26B |

| 🇱🇺 Luxembourg | 🏗️ Tenaris | Oil & Gas Equipment | $22B |

| 🇨🇿 Czech Republic | 💡 CEZ Group | Energy | $20B |

| 🇵🇱 Poland | ⛽ PKN Orlen | Energy | $20B |

| 🇵🇹 Portugal | 🔌 EDP Group | Energy | $16B |

| 🇬🇷 Greece | 🏦 Eurobank | Banking | $7B |

| 🇭🇺 Hungary | ⛽ MOL Group | Energy | $7B |

| 🇭🇷 Croatia | 🏦 Zagrebacka Banka | Banking | $6B |

| 🇷🇴 Romania | ⛽ Romgaz | Energy | $4B |

| 🇸🇮 Slovenia | 💊 Krka | Pharmaceuticals | $4B |

Note: Figures are rounded and last updated on April 15th, 2024. Countries with top publicly-traded companies worth under $4 billion are excluded.

Luxury supergiant LVMH—which owns brands like Tiffany, Christian Dior, and TAG Heuer to name a few—is Europe’s second largest company by market cap, at $420 billion.

Rounding out the top three is ASML, which produces equipment crucial to chip manufacturers, worth $380 billion.

When looking at the region, there is a vast disparity between EU member states and their most valuable companies.

For example, as mentioned earlier, Denmark’s Novo Nordisk and France’s LVMH are worth between $400-550 billion each. Meanwhile, some countries don’t even have a single publicly-listed company that is worth over $1 billion.

In fact, only 12 EU countries (less than half of the union) are home to the top 100 most valuable companies within the bloc. An additional four countries are represented if you look at the list of the top 200 companies.

-

Technology6 days ago

Technology6 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023